The EUR/USD currency pair slightly rebounded upward on Monday after breaking below the moving average line. Let's recall that the end of last week turned out to be quite gloomy for the European currency, although nothing extraordinary occurred. The euro depreciated by a total of 150 points, which is hardly a failure for the single European currency. The real issue is that there were no particular reasons for the fall of the EU currency. However, even if there were no clear reasons, what we witnessed was a typical technical correction.

Since the reasons for the euro's decline cannot be accurately determined at the moment, many analysts are starting to make speculative assumptions. For example, one popular opinion now is that the euro's decline is due to protests and unrest in France. To be frank, the protests could indeed have triggered some pressure on the euro, but such events happen quite often in Europe. Over the past couple of years, there have been several instances of unrest in France alone.

The same goes for political crises. Every few months, some high-ranking official resigns or comes under harsh criticism. For example, in the past two years alone, France has had five different finance ministers. Previously, Olaf Scholz's government in Germany stepped down. In the UK, not a single prime minister has served a full term in the last 10 years. Clearly, such events are far from unusual.

And interestingly enough, protests, high-profile resignations, and budget disputes that threaten a government shutdown also happen regularly in the U.S. Therefore, these types of events occur frequently around the world, and we do not believe that the euro's decline should be attributed solely to any of them.

At the moment, we can say only one thing: Despite the price moving below the moving average, nothing has fundamentally changed for the EUR/USD pair. Even in the 4-hour time frame it is clearly visible that the pair continues to move in the same direction it has followed over the past month and a half. The upward movement is not as strong now as it was in the first half of the year, which is why the price is repeatedly pulling back, while analysts frantically search for a reason for these moves.

Let us remind traders that not every price movement in the market happens "for a reason." Price is formed by supply and demand. Imagine that a major market participant decides to buy a large amount of U.S. dollars using euros. This transaction is carried out, and the price falls. Did such a transaction require any specific fundamental, macroeconomic, or political reasoning? Currency market transactions are not made solely for speculation or profit, contrary to popular belief. Thus, what we saw was a typical downward retracement that simply occurred at an inopportune moment, prompting market participants to search for justification where none is required.

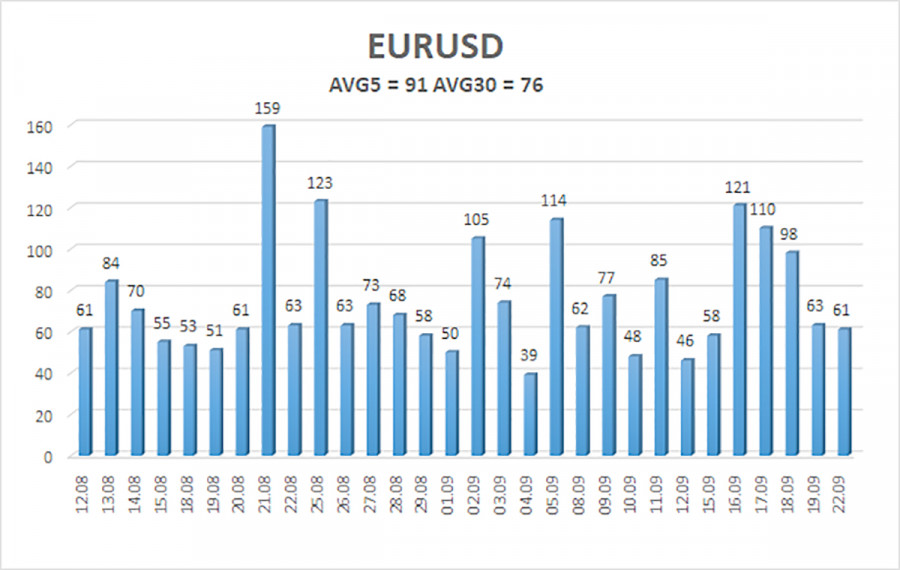

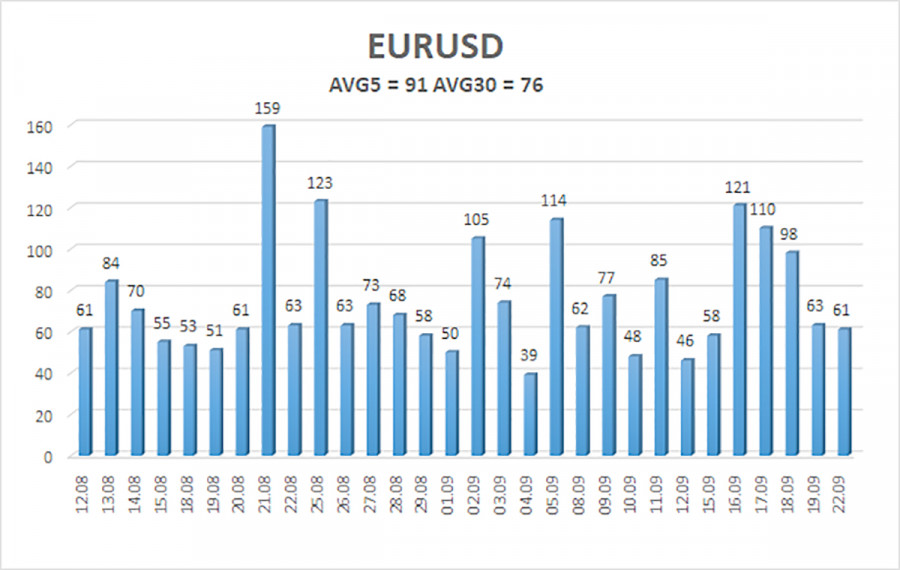

The average volatility of the EUR/USD currency pair over the last 5 trading days as of September 23 is 91 points and is classified as "average." We expect the pair to move between the levels of 1.1683 and 1.1865 on Tuesday. The senior linear regression channel is directed upward, which still points to an ongoing uptrend. The CCI indicator entered the overbought zone last week, which may have triggered a new round of downward correction.

Nearest support levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest resistance levels:

Trading Recommendations:

The EUR/USD pair has begun a new wave of corrective movement; however, the upward trend remains intact, as visible on all timeframes. The U.S. dollar continues to be strongly influenced by Donald Trump's policies, and he does not seem ready to "stop where he is." The dollar rose as much as it could (for an entire month), but now it appears that a new round of prolonged decline is beginning. If the price is located below the moving average, small short positions can be considered with targets at 1.1719 and 1.1683 based solely on technical grounds. If the price remains above the moving average line, long positions remain relevant with targets at 1.1841 and 1.1963 as the trend continues.

Illustration Explanations:

- Linear Regression Channels help to identify the current trend. If both channels are pointing in the same direction, the trend is considered strong.

- Moving Average Line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should be conducted at the moment.

- Murray Levels represent target levels for trends and corrections.

- Volatility Levels (red lines) indicate the projected price range within which the pair may trade over the next 24 hours, based on current volatility.

- CCI Indicator – when it enters the oversold zone (below -250) or the overbought zone (above +250), it indicates a possible trend reversal in the opposite direction.