The GBP/USD currency pair traded sideways on Friday and throughout the current week with low volatility. Recently, significant differences have emerged in the technical picture between the euro and the pound. For instance, the euro has been maintaining a clear and strong consolidation on the daily timeframe, while the British pound is more in a descending correction. On the 4-hour timeframe, the euro is rising, but the pound has been stagnant throughout the week. Why have these differences arisen?

The problem lies within the British pound itself, specifically within the British economy. What have we learned about its condition over the past week? The unemployment rate continues to rise and is increasing faster than forecasts. GDP for the third quarter showed a meager growth of 0.1%, falling short of expectations. Industrial production declined by 2%, which is also much worse than market expectations.

Additionally, the British government, particularly the Treasury, has been unable to draft a budget for the next financial year and cannot even decide whether to raise taxes or cut expenses. This information does not please traders and investors, while there are no similar pools of negative news from the Eurozone. Hence, while the euro may drop, it does so at a much weaker rate than the pound. Conversely, if it rises, it tends to do so stronger than the British currency.

Is there a way out of this situation for the pound sterling? Yes, and that way is the dollar. We continue to consider any decline in the GBP/USD pair as a correction, and corrections, sooner or later, come to an end. The news from the UK has not been very positive, but from the U.S., it has been a continuous flow all through 2025. The American currency has managed to avoid significant declines in recent months only because the market cannot physically keep selling the dollar indefinitely.

On the daily timeframe, we observe a deep downward correction of nearly 50% on the Fibonacci scale, composed of a classic three-wave structure. Thus, if the fundamental backdrop from the UK begins to improve even slightly and simply does not hinder the dollar's decline, the upward trend for 2025 may resume as early as November or December. Of course, if Treasury Secretary Rachel Reeves changes her mind about taxes several times and sheds tears in Parliament under criticism, the pound will struggle to show growth. Still, we believe the fundamental backdrop for the dollar remains much worse than that for the British currency.

Additionally, it is essential to note that over the past month and a half, the GBP/USD pair has not consistently declined even when there were solid reasons for it. Initially, we observed a technical correction, but then disappointing news from the UK began to flow, and the pound continued to decline. However, we believe that this decline is nearing its end.

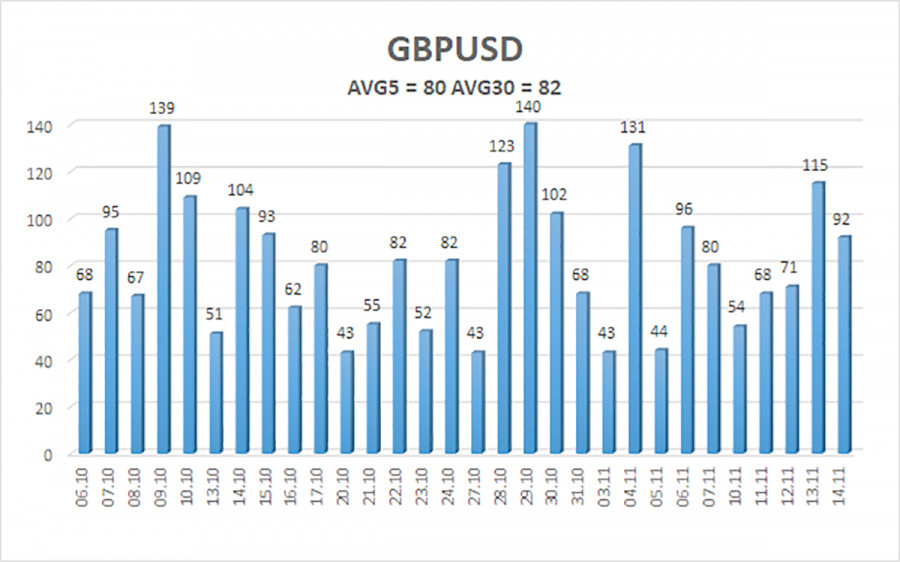

The average volatility of the GBP/USD pair over the past five trading days is 80 pips, which is considered "average" for this pair. On Monday, November 17, we expect movements within the range limited by the levels of 1.3089 and 1.3249. The higher regression channel is directed downwards, but this is only due to the technical correction on higher timeframes. The CCI indicator has entered oversold territory four times, signaling a potential resumption of the upward trend. A new bullish divergence has formed, marking the start of the latest uptick.

Nearest Support Levels:

- S1 – 1.3062

- S2 – 1.2939

- S3 – 1.2817

Nearest Resistance Levels:

- R1 – 1.3184

- R2 – 1.3306

- R3 – 1.3428

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the upward trend of 2025, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the dollar, so we do not anticipate growth from the American currency. Therefore, long positions targeting 1.3306 and 1.3428 remain relevant for the near term when the price is above the moving average. If the price is below the moving average line, small short positions can be considered with targets at 1.3062 and 1.2939 based on technical grounds. From time to time, the dollar shows corrections (on a global scale), but for a trend to strengthen, it needs real signs of an end to the trade war or other positive global factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, it indicates that the trend is currently strong.

- The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will spend the following days, based on current volatility indicators.

- The CCI indicator entering the oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.