The euro and the pound continued moving higher following more or less clear data from the euro area and the latest speeches by U.S. Federal Reserve officials.

The European currency, supported by disagreements within the Fed, demonstrated resilience and a willingness to rise. The market, which is highly sensitive to the slightest signals, picked up on notes of uncertainty in the central bank's unified stance. A split in opinions within the Fed creates a favorable backdrop for the euro strengthening. Traders, who previously feared aggressive monetary policy in the U.S., now see more room for maneuver from the American central bank. Despite cautious statements from some Fed officials, the overall picture remains uncertain. Goolsbee, calling for real-time decision-making, emphasizes that future policy will depend on incoming economic data. Meanwhile, a number of other committee members have advocated a softer stance on interest rates.

Today promises to be eventful for currency traders closely watching the European economy. The focus is on the release of euro area GDP data for the second quarter of this year. This figure will be a key indicator to assess the pace of recovery after a challenging first quarter marked by geopolitical instability and an energy crisis. Data on changes in employment levels are of particular interest. Employment growth will certainly be a positive signal, indicating labor market resilience and consumer confidence. However, a slowdown in hiring could point to emerging problems in the economy, which, in turn, would put pressure on the euro. Finally, equally important is the report on changes in industrial production for June. Industrial production is a barometer of economic health, reflecting the dynamics of supply and demand in the real sector.

As for the pound, today also promises to be a decisive day. Traders are holding their breath ahead of key macroeconomic releases that will certainly shed light on the UK's economic outlook. The focus is on the GDP report. This figure, reflecting the total value of all goods and services produced, is a barometer of the country's economic health. The data is expected to show moderate growth, but any deviation from the forecast could trigger a sharp reaction in the currency market. Equally important is the report on changes in industrial production. As the driving force of the economy, industrial production responds sensitively to changes in consumer demand and business activity. Growth in industrial production indicates an economic revival, which would support the pound.

All these factors combined will determine the further trajectory of the GBP/USD and EUR/USD pairs. A successful release of macroeconomic data could act as a catalyst for the continuation of the upward trend, while negative results could trigger a correction.

If the data matches economists' expectations, it is better to act based on a Mean Reversion strategy. If the data turns out to be much higher or lower than economists' expectations, the Momentum strategy is preferable.

Momentum Strategy (Breakout):

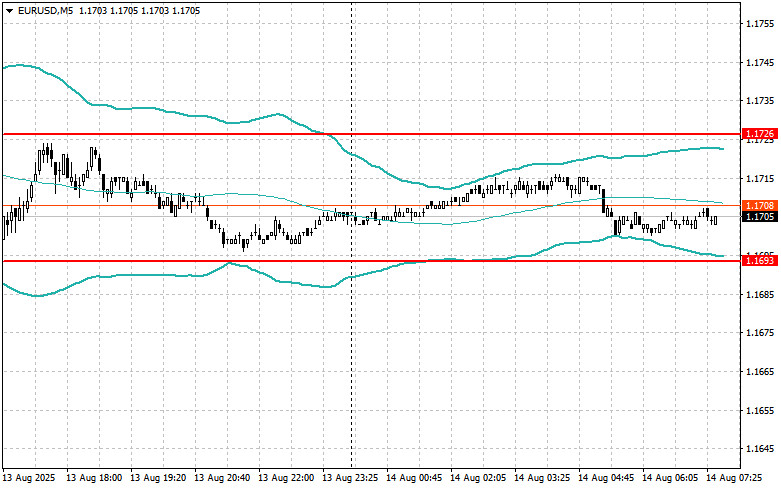

EUR/USD

Buying on a breakout above 1.1715 could lead to growth toward 1.1745 and 1.1775;

Selling on a breakout below 1.1695 could lead to a decline toward 1.1666 and 1.1635.

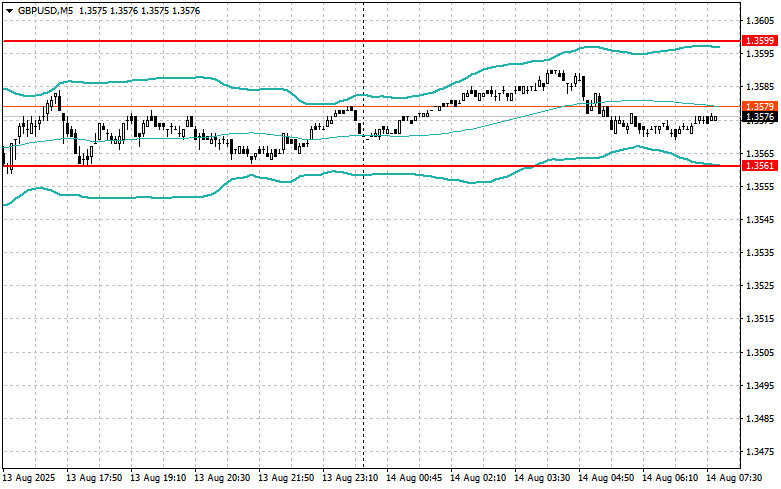

GBP/USD

Buying on a breakout above 1.3585 could lead to growth toward 1.3615 and 1.3645;

Selling on a breakout below 1.3560 could lead to a decline toward 1.3530 and 1.3500.

USD/JPY

Buying on a breakout above 146.65 could lead to growth toward 147.00 and 147.34;

Selling on a breakout below 146.31 could lead to a decline toward 145.90 and 145.60.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look for selling opportunities after a failed breakout above 1.1726, with a return below this level;

Look for buying opportunities after a failed breakout below 1.1693, with a return above this level.

GBP/USD

Look for selling opportunities after a failed breakout above 1.3599, with a return below this level;

Look for buying opportunities after a failed breakout below 1.3561, with a return above this level.

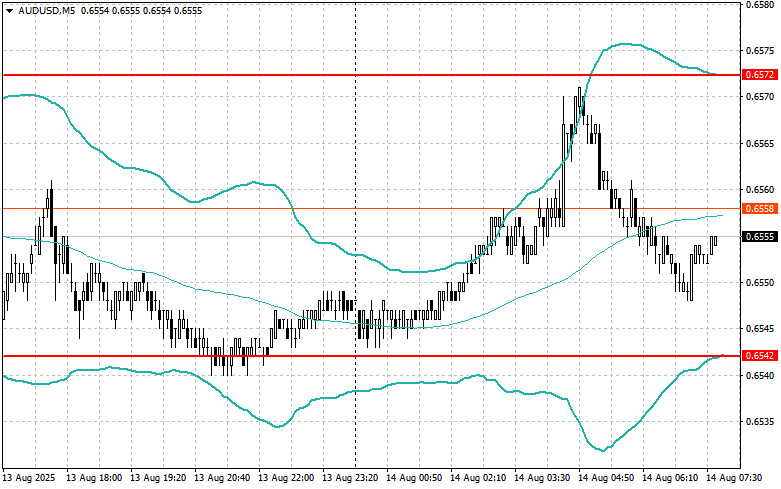

AUD/USD

Look for selling opportunities after a failed breakout above 0.6572, with a return below this level;

Look for buying opportunities after a failed breakout below 0.6542, with a return above this level.

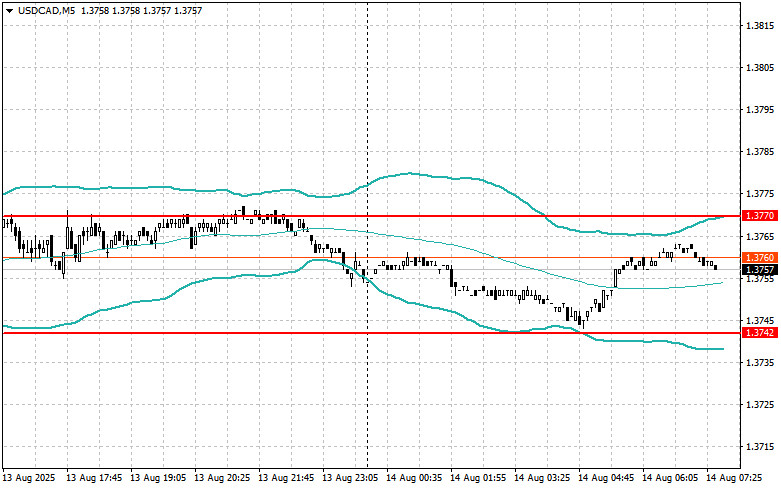

USD/CAD

Look for selling opportunities after a failed breakout above 1.3770, with a return below this level;

Look for buying opportunities after a failed breakout below 1.3742, with a return above this level.