Bitcoin has reached a new all-time high, while Ethereum narrowly missed achieving the same milestone. In the past 24 hours, Bitcoin has increased by 3.17% and is currently trading at $121,400, after previously hitting a record high of $124,300. As the world's largest cryptocurrency, Bitcoin is now the fifth-largest asset by market capitalization, valued at $2.452 trillion, which exceeds Google's market capitalization of $2.448 trillion.

Meanwhile, as Bitcoin continues to reach new highs, data shows that Elon Musk's SpaceX Bitcoin holdings have surpassed the $1 billion mark. According to Arkham Intelligence, Musk's aerospace company currently holds 8,285 BTC, worth about $1.02 billion.

SpaceX's entry into the world of cryptocurrencies is not just an asset diversification move but a strategic step that demonstrates the company's belief in the future of digital currencies. Musk's investments, known for their innovative nature, provide Bitcoin with an additional boost and strengthen its position as a legitimate financial instrument. Surpassing the $1 billion threshold indicates the soundness of the chosen strategy and the potential profitability of investing in Bitcoin. This success will likely inspire other large companies to consider adding cryptocurrencies to their portfolios, which, in turn, could lead to further market growth and increased liquidity.

However, this is not the first time SpaceX has earned such significant returns from holding Bitcoin.

SpaceX's assets, tracked since early 2021, rose to a total value of $1.8 billion by April of that year. At that time, the company held about 28,000 BTC. SpaceX reduced its holdings by roughly 70% in mid-2022 to the current level. This may have been triggered by the market shock caused by the Terra-Luna collapse in May, the FTX crash in November, and the subsequent domino effect. According to the data, the company has not purchased more Bitcoin since then. Over the same period, Tesla also sold most of its Bitcoin holdings and now holds 11,509 BTC worth $1.42 billion.

As for the intraday strategy in the cryptocurrency market, I will continue to rely on any significant pullbacks in Bitcoin and Ethereum, expecting the medium-term bullish trend—which remains intact—to continue.

For short-term trading, the strategy and conditions are outlined below.

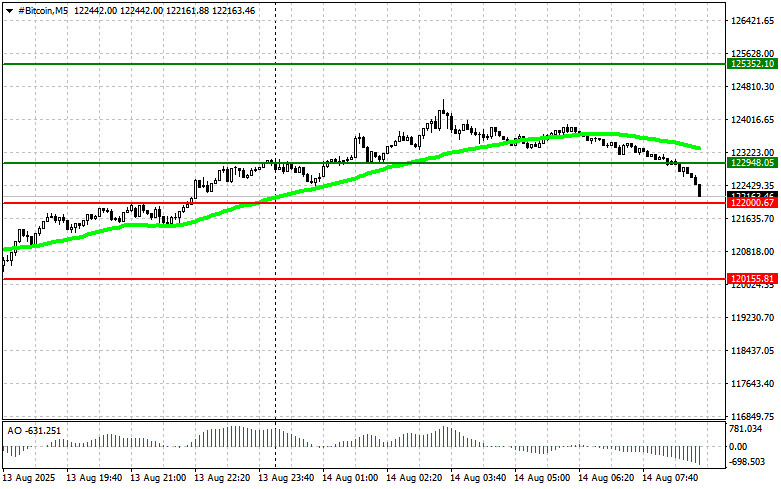

Bitcoin

Buy Scenario

Scenario No. 1: I plan to buy Bitcoin today upon reaching the entry point around $122,900 with a target of rising to $125,300. Around $125,300, I will exit long positions and sell immediately on the pullback. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario No. 2: Bitcoin can also be bought from the lower boundary of $122,000 if there is no market reaction to its breakout, aiming for a reversal toward $122,900 and $125,300.

Sell Scenario

Scenario No. 1: I plan to sell Bitcoin today upon reaching the entry point around $122,000 with a target of falling to $120,100. Around $120,100, I will exit short positions and buy immediately on the pullback. Before selling on a breakout, make sure that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario No. 2: Bitcoin can also be sold from the upper boundary of $122,900 if there is no market reaction to its breakout, aiming for a reversal toward $122,000 and $120,100.

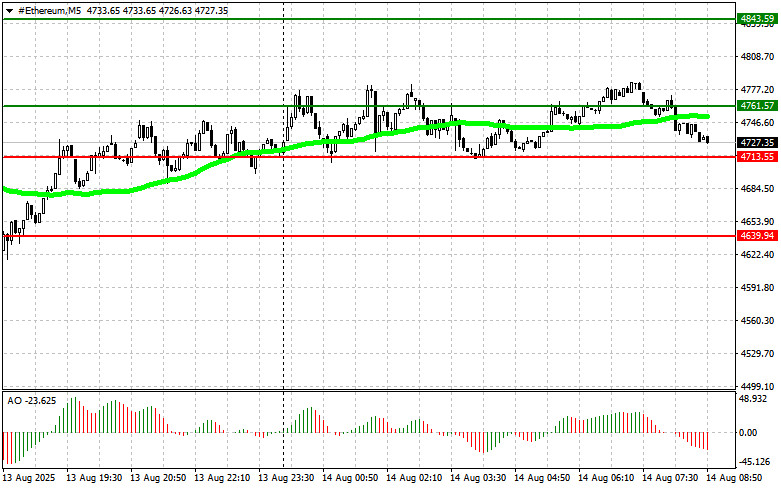

Ethereum

Buy Scenario

Scenario No. 1: I plan to buy Ethereum today upon reaching the entry point around $4,761 with a target of rising to $4,843. At around $4,843, I will exit long positions and sell immediately on the pullback. Before buying on a breakout, make sure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario No. 2: Ethereum can also be bought from the lower boundary of $4,713 if there is no market reaction to its breakout, aiming for a reversal toward $4,761 and $4,843.

Sell Scenario

Scenario No. 1: I plan to sell Ethereum today upon reaching the entry point around $4,713 with a target of falling to $4,639. At around $4,639, I will exit my short positions and buy immediately on the pullback. Before selling on a breakout, make sure that the 50-day moving average is above the current price and that the Awesome Oscillator is below zero.

Scenario No. 2: Ethereum can also be sold from the upper boundary of $4,761 if there is no market reaction to its breakout, aiming for a reversal toward $4,713 and $4,639.