Monday's trade review:

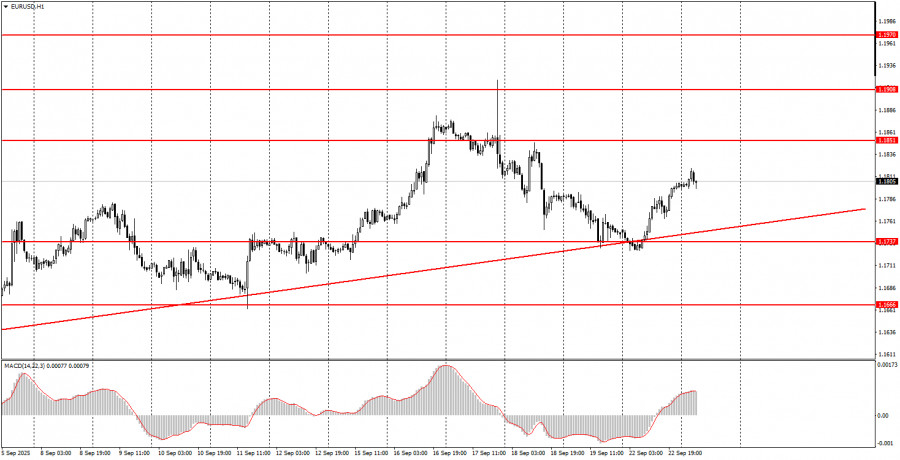

EUR/USD 1H chart

On Monday, the EUR/USD currency pair rebounded from the upward trendline and started recovering quickly, despite the lack of fundamental or macroeconomic support. No major events or data releases were scheduled in either the Eurozone or the US, so the euro's rise was purely technical. Unfortunately, the rebound from the trendline was not the clearest or most precise, but it was present nonetheless. Therefore, the rather illogical decline of the euro last week can be considered over.

Recall that the main driver of the euro's fall was the sharp drop in the pound, which had valid reasons for its weakness. The pound simply pulled the euro lower due to their high correlation. The euro itself had no reason to fall, and the dollar had no reason to strengthen—and still doesn't.

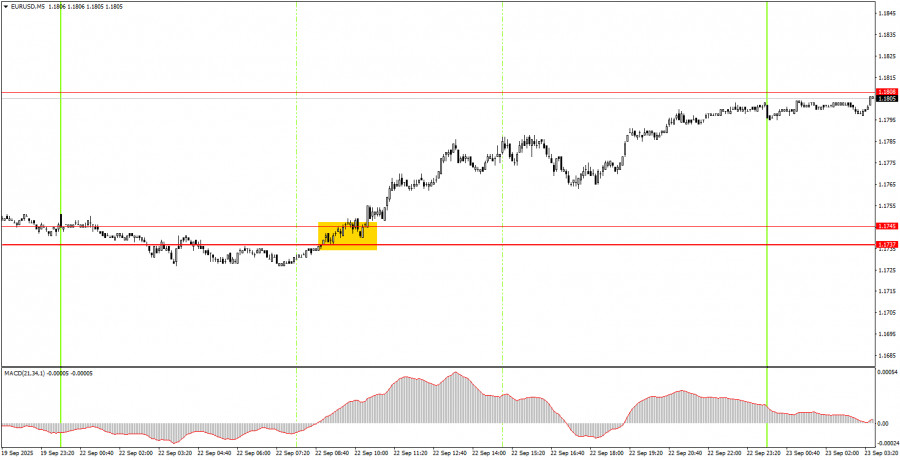

EUR/USD 5M chart

On the 5-minute timeframe, a single buy signal was formed early in the European session. The price broke through the 1.1737–1.1745 level and moved in one direction throughout the entire day, reaching the nearest target level of 1.1808 overnight. At this point, it cannot be said that the upward movement is complete.

How to Trade on Tuesday:

On the hourly timeframe, the EUR/USD pair shows strong growth potential, and the short-term trend remains upward. The fundamental and macroeconomic backdrop continues to provide no support to the U.S. dollar, so we still do not expect significant strengthening of the American currency. In our opinion, the dollar can only expect to benefit from technical corrections — one of which we witnessed on Thursday and Friday. The Fed meeting didn't change the dollar's outlook in any way.

On Tuesday, the EUR/USD pair may continue moving north, although the macroeconomic backdrop will be quite busy today, so price movements may be mixed. Even if the dollar somehow strengthens again, this won't change the overall situation.

On the 5-minute timeframe, consider the following levels: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Tuesday, the Eurozone and the U.S. will publish business activity indexes in the services and manufacturing sectors. These publications can't be called highly important, but deviations from forecasts may lead to a noteworthy market reaction.

Key Trading System Rules:

- The strength of a signal is determined by the time it takes to form (bounce or break through a level). The less time it takes, the stronger the signal.

- If two or more false signals were generated near a given level, all subsequent signals from that level should be ignored.

- During flat (sideways) markets, any currency pair can generate many false signals or none at all. In any case, at the first signs of a flat market, it's better to stop trading.

- Trades should be opened during the period from the start of the European session to the middle of the American session. All trades should be manually closed after this period.

- On the hourly chart, MACD indicator signals should ideally be used only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be considered as a single support or resistance zone.

- After a price moves 15 pips in the correct direction, set your Stop Loss to breakeven.

What's on the charts:

- Price support and resistance levels — targets for opening buy or sell trades. Take Profit levels can be placed near them.

- Red lines — trendlines or channels, showing the current trend and the preferred trade direction.

- MACD indicator (14, 22, 3) — histogram and signal line — an auxiliary tool that can also be used for trade signals.

Important: Key speeches and reports (always listed in the economic calendar) can strongly influence currency pair movements. During such releases, trade with maximum caution or exit the market altogether to avoid sharp reversals against the prior trend.

Note for beginners: Not every trade can be profitable. A clear strategy and proper money management are the foundation for long-term success in trading. Impulsive trading decisions based on the current market situation are, by definition, a losing strategy for an intraday trader.