The GBP/USD currency pair spent most of Tuesday standing still. In the UK, business activity indices for the services and manufacturing sectors were published yesterday, but they only triggered convulsions in the price at the same levels. This is quite strange, since both business activity indices not only fell in September but also turned out to be significantly below forecast values. Thus, the British pound had grounds to fall in the first half of the day. Why then did the pound not continue its decline, given that it had been falling so actively in the previous few days?

We have already mentioned that the pound's decline was triggered by new budget problems of the British government. The euro's fall also provoked a decline in the British pound. Therefore, if not for the new budget issues, the pound would have continued its upward movement without difficulty. Let us recall that the results of the Fed's meeting can be confidently considered "dovish," while the results of the Bank of England's meeting were "neutral." In other words, the American regulator signaled readiness to continue cutting rates, while the Bank of England did not.

Of course, as many analysts and traders as there are, there will be as many opinions. Some interpreted the Bank of England's meeting as containing "dovish notes," but we do not think so. The reason for the pound's decline is obvious, and there is no need to invent explanations. Moreover, technical analysis always comes to the rescue, indicating what to expect in the near future. And the fact that the pound avoided further decline yesterday, despite having every chance to continue falling, points to a likely end of the downward correction.

Let us also recall that inflation in the UK, if not skyrocketing, is almost twice the target level. We believe that with such inflation, even a third round of monetary policy easing in 2025 should not have happened, let alone a fourth. Some may argue that the weakness of the British economy could force the Bank of England to continue cutting rates, but we remind you that the British economy has shown weakness since 2016. This phenomenon did not emerge recently. For years, both the regulator and the government tolerated weak economic growth. Why, then, is urgent intervention by the central bank suddenly required?

It should also be noted that the UK has serious budget problems. Expenditures are growing, revenues are not. The only way out is to cut social and healthcare programs and raise taxes. We cannot say these are very bad news for the pound sterling, because they are balanced by the American economy, which also faces plenty of problems. In any case, another key rate cut will almost certainly lead to higher inflation. Either the Bank of England will have to abandon inflation targeting, or it will be unable to lower the key rate further — which is very favorable for the pound.

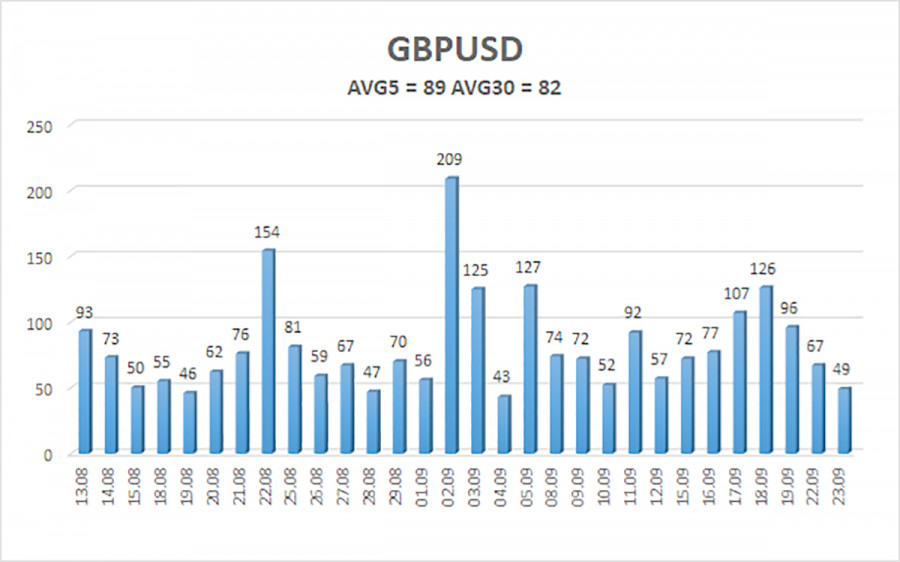

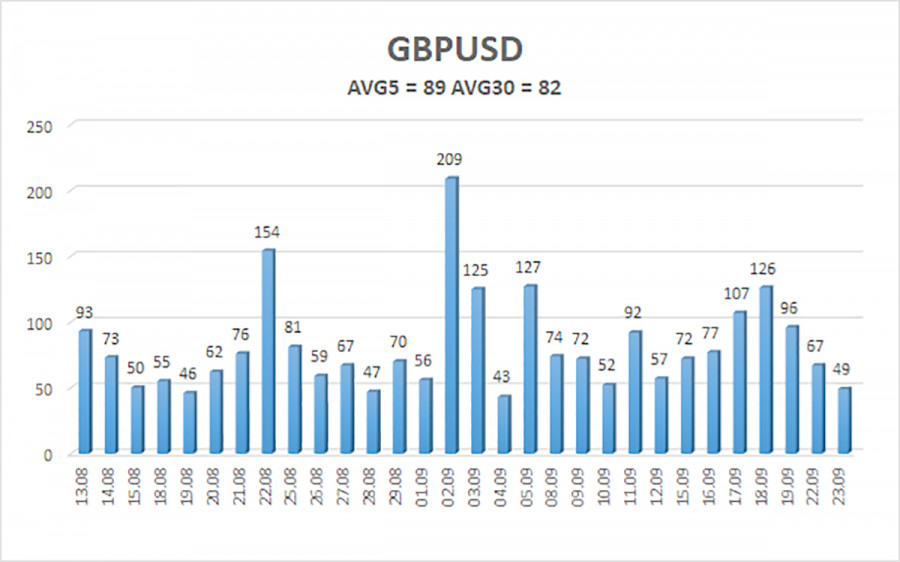

The average volatility of the GBP/USD pair over the last 5 trading days is 89 points. For the pound/dollar pair, this value is considered "average." On Wednesday, September 24, we therefore expect movement within the range defined by the 1.3427 and 1.3605 levels. The senior linear regression channel is directed upward, which clearly indicates an uptrend. The CCI indicator once again entered the oversold zone, which again signaled a resumption of the upward trend.

Nearest support levels: S1 – 1.3489 S2 – 1.3428 S3 – 1.3367

Nearest resistance levels: R1 – 1.3550 R2 – 1.3611 R3 – 1.3672

Trading recommendations: The GBP/USD pair is once again correcting, but its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the dollar, so we do not expect any growth from the American currency. Thus, long positions with targets at 1.3672 and 1.3733 remain much more relevant if the price stays above the moving average. If the price falls below the moving average line, small short positions can be considered on purely technical grounds. From time to time, the U.S. currency shows corrections (as now), but for a trend-based strengthening it needs real signs of the end of the World Trade War or other global, positive factors.

Explanations for illustrations:

- Linear regression channels help determine the current trend. If both point in the same direction, the trend is strong.

- Moving average line (settings 20.0, smoothed) defines the short-term trend and the direction in which trading should be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel in which the pair will trade over the next day, based on current volatility indicators.

- CCI indicator – entering the oversold area (below -250) or overbought area (above +250) means that a trend reversal in the opposite direction is approaching.